This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

For an economy

in service

of life

thousands of people and organisations are working towards a wellbeing economy

Become a Member Receive updatesWhat is the

economy?

Simply put, it’s the way that we produce and provide for one another. We often think of the economy as something given, fixed and unchangeable – but it’s not. The rules, social norms and stories that underpin our current system were designed by people, and that means they can also be changed by people.

What is a

Wellbeing

Economy?

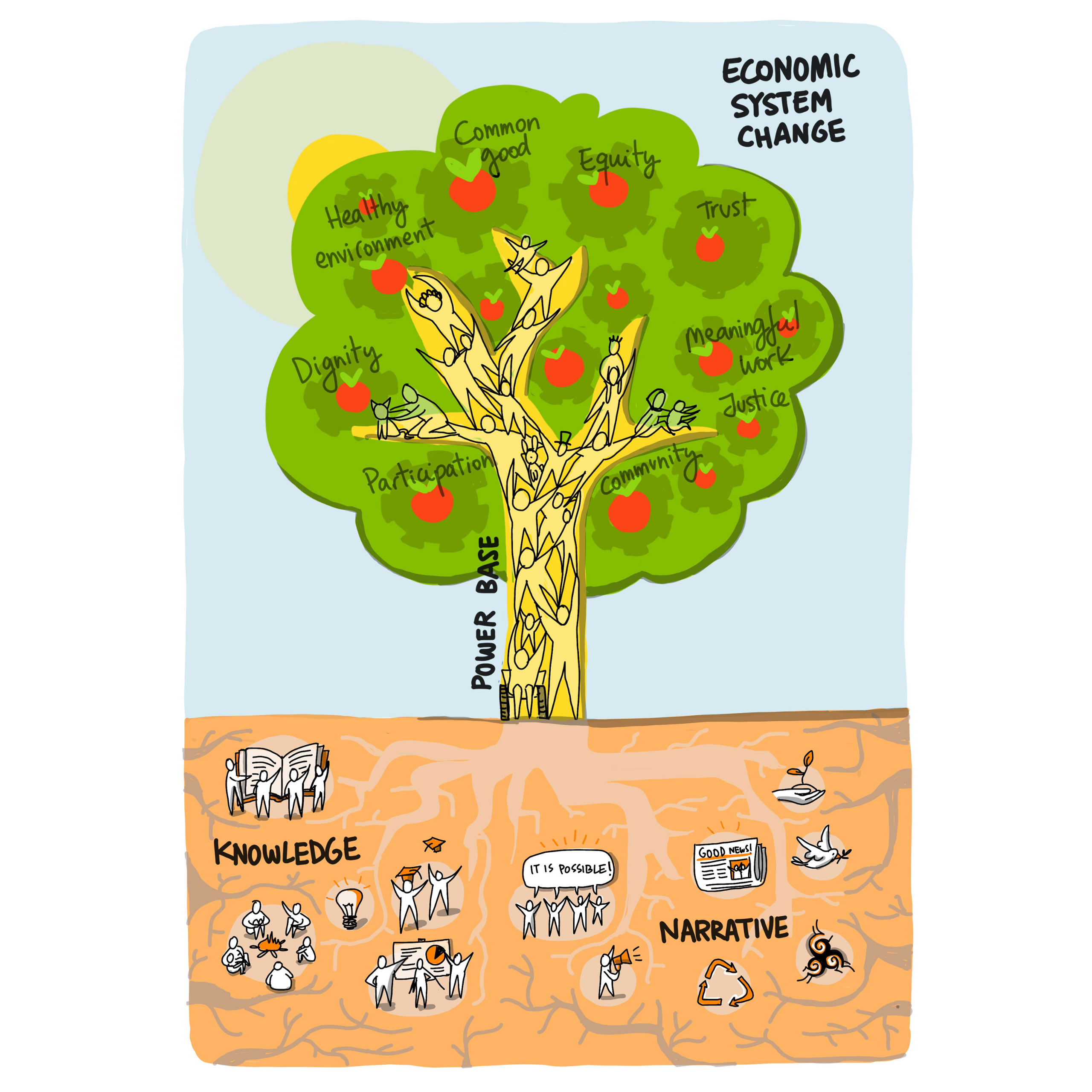

A Wellbeing Economy is an economy designed to serve people and planet, not the other way around. In a Wellbeing Economy, the rules, norms and incentives are set up to deliver quality of life and flourishing for all people, in harmony with our environment, by default.

Why do we

need a

Wellbeing

Economy?

A Wellbeing Economy directly addresses the root problems of our society and the multiple crises we are facing by putting our fundamental needs for Dignity, Nature, Purpose, Fairness and Participation at the core of its activities and getting things right the first time around.

How are we

Transitioning

to a Wellbeing

Economy?

We bring together multiple actors across all regions, sectors and levels of our system to influence societal values and norms, and above all, to show that change is necessary and possible. Our underpinning value is that collaboration and togetherness define both our destination and also how we get there. Transformation calls for an entirely different way of being within human society: a shift from “us vs them” to “WE All”.

who is

part of the

alliance

We are a global collaboration of changemakers and disruptors questioning the status quo. Whether you represent an organization, a business, a government agency or are working independently towards a Wellbeing Economy, we can learn from one another and accelerate change together.

400+ organisations

6 national governments

88 ambassadors

150 academics

15 local hubs

Quotes & tweets

about us

On the Spotlight

Wellbeing

Economy

Resources

There is a huge number of resources available on the Wellbeing Economy. We’re constantly updating this library with works produced by WEAll and our members to help guide you and your organisation in your learning and practice.

Curious about the connections between the climate crisis and our economic system? Find out how moving beyond GDP can help us to safeguard the environment.

Resources for refusing ‘business as usual’ and implementing regenerative and distributive solutions

Understanding why our current system is costing us more than it is helping us

Our current economic system is based on the exploitation of people and planet and we cannot build a Wellbeing Economy without confronting past and present racism and colonisation.

A guide to reshaping our cultural narratives in service of life